Insider Brief

- Eutelsat’s stock surged nearly 650% in four days before retreating, driven by retail traders, speculation over its potential role in Ukraine’s internet infrastructure, and short squeeze dynamics, according to Reuters.

- Analysts at Bernstein and Kepler Cheuvreux compared the rally to the 2021 GameStop phenomenon, noting leveraged bets from retail investors and geopolitical shifts following a dispute between Ukrainian President Volodymyr Zelenskiy and U.S. President Donald Trump.

- Despite the stock surge, Eutelsat faces financial struggles, with Moody’s and Fitch issuing downgrades, and the company requiring an estimated $4.2 billion in funding through 2032.

Shares European satellite operator Eutelsat (ETL.PA) surged this week in a dramatic rally that has drawn comparisons to the 2021 GameStop phenomenon.

Over four days, the stock climbed nearly 650% before retreating, fueled by retail traders and speculation over the Franco-British company’s potential role in providing internet to Ukraine in direct competition to Elon Musk’s Starlink and short interest buying pressure, according to Reuters.

The rally began after a public dispute between Ukrainian President Volodymyr Zelenskiy and U.S. President Donald Trump, followed by Washington’s decision to pause military aid to Ukraine. Investors quickly seized on the idea that Eutelsat could emerge as an alternative to Elon Musk’s Starlink for delivering internet access to Ukraine. This speculation, coupled with heavy short interest in the stock, triggered a wave of buying pressure, forcing short sellers to cover their positions, Reuters reported.

“This is a classic short squeeze of relatively unheard-of proportions, but to be fair, proportionate to the tectonic shifts we see in global geopolitics since the election of Trump,” Bernstein analyst Aleksander Peterc told Reuters.

By Thursday, Eutelsat shares had risen sixfold over the previous three trading sessions, with an 18% gain early in the day pushing its market valuation above 4 billion euros ($4.3 billion) before pulling back. At 1606 GMT, the stock was down 11%, though trading volumes remained exceptionally high.

Analysts at Kepler Cheuvreux suggested that leveraged bets from retail investors had amplified the move, creating what they termed a “French version of the GameStop effect.”

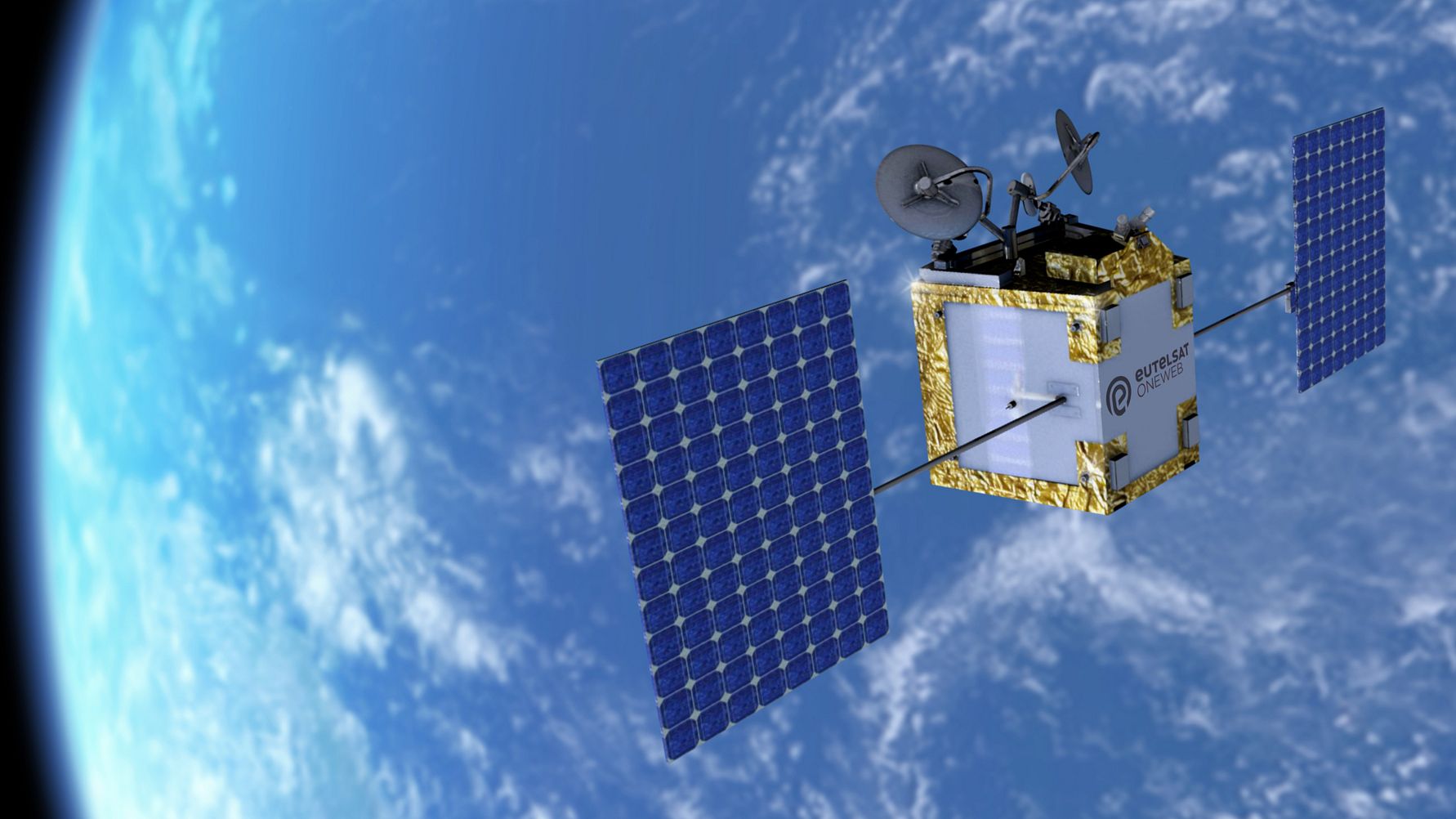

Despite the surge, Eutelsat has struggled financially. Moody’s downgraded the company’s credit rating in January, citing weak performance of its OneWeb satellite business and significant investment needs that have pressured cash flow, Reuters reported.

Eutelsat Group announced it has partnered with Airbus Defence and Space to build an extension of its OneWeb low Earth orbit (LEO) satellite constellation to enhance OneWeb’s capacity and technological capabilities. Under the contract, Airbus will produce the initial batch of 100 satellites for the constellation’s extension. Delivery is scheduled to begin at the end of 2026.

This week, Rocket Lab announced it was selected by Airbus to manufacture 200 solar panels to power those satellites.

Eutelsat remains in talks with the European Union about providing additional internet access to Ukraine, adding to investor interest. The company is also in discussions with the Italian government regarding a secure satellite communications system, sources told Reuters. Bondholders appeared to share some of the renewed optimism, as Eutelsat’s 2029 9.75% bond saw its yield drop to 10.1% from a February peak of 16.7%.

Fitch Ratings cut Eutelsat’s long-term rating on Thursday, issuing a negative outlook and warning that the company could require an estimated $4.2 billion in additional funding through 2032.

Share this article: