By Julia Seibert with contributions from Anup Gholap

India’s space program is on a roll. Within the last year, the country’s space agency ISRO (Indian Space Research Organisation) landed on the moon, launched a few astronomy probes, and tested out its abort systems for future human spaceflights. Beyond the limelight, India is also home to a ballooning space startup industry hoping to capture a slice of the global market. Along with its efficiency, low costs, and government support, ISRO recently reshuffled its bureaucracy to encourage commercial participation, and it seems well poised to do so. But can they pull it off?

5 Top Space Startups In India In 2024

Pixxel

Location: Bengaluru/California

Founded: 2019

Number of employees: 100+

Current funding level: Series B

Amount raised (USD): ~ $71 million

Latest funding amount: $36 million

LinkedIn: https://www.linkedin.com/company/pixxelspace

Pixxel‘s specialty is satellites – hyperspectral imaging satellites, to be exact. The company is working to build up a constellation of 24 small satellites in Earth’s orbit that will image the globe in hundreds of wavelengths, revealing details that otherwise may be missed. These might include the spectral signatures of various materials, chemicals, and biological processes, making the service useful to agricultural, energy, and environmental industries. Once complete, the constellation can visit a site every 24 hours to analyze change over time. Pixxel hopes to enhance this service by means of its analytics platform Aurora. For its efforts, the company snagged millions in investments from Google as well as a juicy contract from the US’s National Reconnaissance Office (NRO). With three satellites launched, Pixxel plans to launch six more in 2024 and another 12 the following year.

Skyroot

Location: Hyderabad

Founded: 2018

Number of employees: 200+

Current funding level: pre-Series C

Amount raised (USD): $95 million

Latest funding amount: $27.5 million

LinkedIn: https://www.linkedin.com/company/skyroot-aerospace/

Skyroot’s goal, founder Pawan Chandana told CNN in April, is to build ‘cabs to get into space’. The company focuses on small rockets, which – while more expensive on the kilo-to-orbit front – can bring its payloads to highly specific orbital locations. Chandana explains that the company isn’t directly competing directly with giants like SpaceX, whose rockets can launch hundreds of satellites at a time for cheap. Instead, Skyroot offers bespoke missions that are more affordable than similar Western companies due to India’s track record of low-cost space missions. Skyroot’s first rocket, Vikram-S, became India’s first privately launched rocket when it flew in November 2022. Sometime in 2024, the company hopes to debut Vikram-1, capable of lugging 500 kilograms into a low Earth orbit. This makes it ideal for launching small satellites, which make up the vast majority of spacecraft launched globally. Different variations of the vehicle with higher payload capacities are also advertised on the company’s websites. While these would be single-use vehicles, the company plans to eventually make its rockets reusable to further lower costs.

AgniKul

Location: Chennai

Founded: 2017

Number of employees: ~ 200

Current funding level: Series B

Amount raised (USD): >$40 million

Latest funding amount: $26.7 million

LinkedIn: https://www.linkedin.com/company/agnikul-cosmos/

Like Skyroot, Agnikul is also eyeing the potential of launching small satellites out of India. Its model is grounded in customizability; its rocket, AgniBaan, is designed like Lego, with the number of engines, presence of a third stage, and launch location determined by the customer. Much of the rocket is 3D-printed, and the company even advertises a truck-mounted launchpad with access to several launch sites to increase versatility. While AgniBaan hasn’t flown yet, AgniKul recently launched its first suborbital test flight of its AgniBaan Suborbital Technology Demonstrator (SORTED) rocket. This vehicle featured a single-piece 3D-printed rocket engine – the world’s first, the company said – and pulled off a flawless maiden flight.

Dhruva Space

Location: Hyderabad

Founded: 2012

Number of employees: 80+

Current funding level: Series A

Amount raised (USD): ~$19 million

Latest funding amount: $15 million

LinkedIn: www.linkedin.com/company/dhruvaspace/

While other companies focus on the rockets, Dhruva is honing in on the smallsats themselves, describing itself as a ‘full-stack space engineering solutions provider’. Dhruva’s services fall into three broad categories: modular small satellite platforms, satellite deployment mechanisms, and ground services. With this model, the company is akin to a one-stop shop for anyone wanting to get in on the smallsat game; Satya Narayan Bansal, founder and CEO of investment firm Blue Ashva, has described them as the Shopify of satellites (as reported by Geospatial World). In India’s young space startup scene, Dhruva is somewhat of a veteran; its systems have already been tested in space several times, and two of its satellites launched in November 2022 became the first private Indian sats in orbit.

Bellatrix Aerospace

Location: Bengaluru

Founded: 2015

Number of employees: 50+

Current funding level: Series a

Amount raised (USD): $11 million

Latest funding amount: $8 million

LinkedIn: www.linkedin.com/company/bellatrix-aerospace

Bellatrix is all about satellite propulsion – from water to electric to miniature. The company had originally planned on building a two-stage rocket before focusing on propulsion alone. To date, its technologies have flown on three missions. Two tested its hall-effect thrusters, an electric propulsion system whereby ions – positively charged atoms – are accelerated and expelled by an electric field. The third tested a propellant designed as a greener alternative to hydrazine, a toxic chemical usually used for satellite fuel. The company is also developing a microwave plasma thruster powered by water, a fingernail-sized thruster designed for nanosats (typically less than ten kilograms in mass), and an orbital transfer vehicle to haul satellites to their designated orbits.

The Current Space Tech Landscape in India

India’s emerging space industry is gaining momentum on several fronts. A key strength lies in its abundant pool of young talent, with approximately 1.5 million engineers graduating annually from the country’s numerous engineering colleges as of 2022. Over the past decade, there has been a notable rise in private space technology companies in India. Our Space Impulse Database has identified nearly 200 space startups across different Upstream and Downstream segments. The database has mapped 191 space tech companies across India by region (see Chart 1), with Bengaluru leading the charge due to its status as the headquarters of ISRO and its established space ecosystem.

In 2020, the Indian government, under the leadership of Prime Minister Modi, enacted landmark policy reforms that opened up the space sector to private enterprises. This marked a decisive shift from a state-controlled industry to one that actively encourages private sector involvement. Key initiatives included the establishment of the Indian National Space Promotion and Authorization Center (IN-SPACe), tasked with facilitating and regulating private sector activities, as well as reducing bureaucratic obstacles to attract greater private investment.

These reforms have been instrumental in fueling the growth of space startups, with approximately 37% of India’s space companies being founded between 2020 and 2024 (see Chart 2). During the same period. The private Space Tech companies collectively raised around $322 million in funding during 2020-2024 (see Chart 3). The Indian government, aiming to build a $44 billion space industry by 2033, has revamped its legislative framework to provide young companies with access to critical infrastructure and technical expertise. ISRO’s chairman, S Somnath recently indicated that India’s space agency expects a 20%-30% increase in its budget in the coming years.

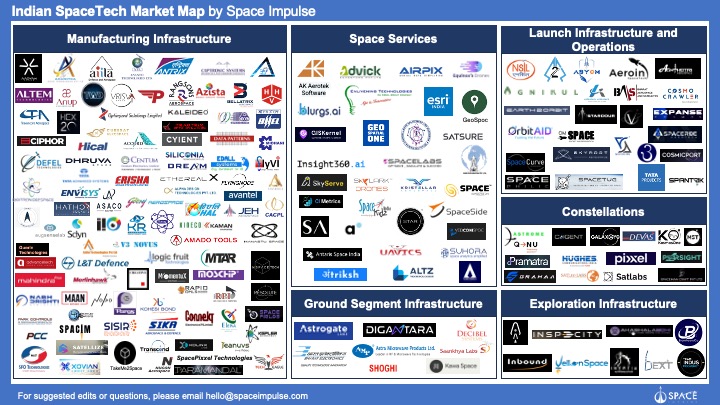

Indian Space Tech Companies Market Map

While the companies listed above are making their mark on the world stage, there are several other space tech companies coming out of India that are hot on the top 5’s tails. Space Impulse has conducted a comprehensive analysis of 191 Space tech companies. For the purpose of this study, the team exclusively focused on commercial entities that align with the Space Impulse Market Intelligence Platform proprietary taxonomy, excluding universities and government bodies. The data is organized into two key sections:

Dashboard

Database

Future of Space Industry in India

Despite strong competition from well-established U.S. firms and operating with more modest budgets, Indian space startups are compelled to innovate rapidly. As frequently highlighted by industry leaders like Chandana, India’s success in spaceflight is deeply rooted in its cost-effective approach—something that CNN has reported as being “in the DNA” of Indian space ventures.

There are caveats, though. One significant hurdle is a relative lack of domestic government funding; juicy contracts by NASA and others are what propelled SpaceX toward becoming the giant it is today. Compared to NASA’s budget, which lingers around the $25 million mark, India’s Department of Space makes do with just $1.6 billion. For rockets in particular, there’s not much of a domestic market aside from the few startups ready to test their hardware in space and ISRO itself – which not only has its own mature rockets, but also sells launches on them through its commercial arm Antrix. That leaves Indian rocket companies in the awkward position of competing against their own government. The decider will be Indian companies’ success in bidding for contracts outside governmental missions (as reported by CNN).

On paper, Indian space startups’ potential is clear. Now they just need to bring it to life.

Share this article: