Insider Brief:

- Rocket Lab USA announced that it has signed a preliminary memorandum of terms with the Department of Commerce to receive up to $23.9 million in funding under the CHIPS and Science Act.

- The investment will boost the production of compound semiconductors for spacecraft and satellites and is expected to create over 100 jobs.

- In addition to federal support, the State of New Mexico has pledged $25.5 million in financial incentives to back Rocket Lab’s expansion.

Rocket Lab USA announced that it has signed a preliminary memorandum of terms with the Department of Commerce to receive up to $23.9 million in funding under the CHIPS and Science Act. The investment aims to boost the production of compound semiconductors for spacecraft and satellites at Rocket Lab’s facility in Albuquerque, New Mexico. The expansion is expected to create over 100 direct manufacturing jobs, significantly strengthening the local economy and national semiconductor supply chain.

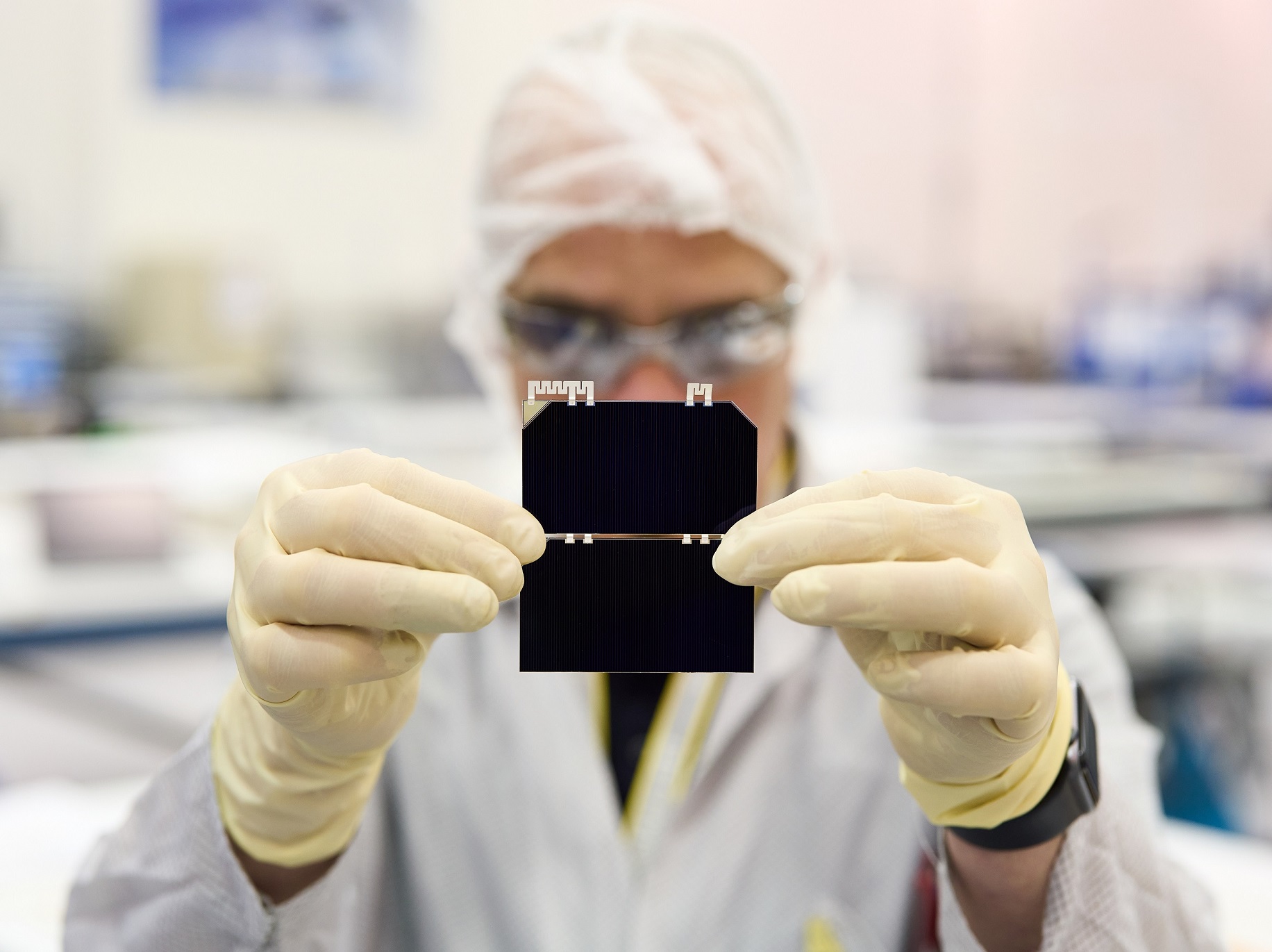

Rocket Lab, which acquired SolAero Technologies in 2022, is one of the few companies capable of producing space-grade solar cells in the United States. These high-efficiency, radiation-resistant solar cells are crucial for a range of space missions, from missile detection systems to scientific explorations like the James Webb Space Telescope and the Ingenuity Mars Helicopter. The expansion will increase Rocket Lab’s compound semiconductor production by 50% over the next three years, meeting the growing demand for space technology.

In addition to federal support, the State of New Mexico has pledged $25.5 million in financial incentives to back Rocket Lab’s expansion. This move aligns with the state’s goal to foster advanced manufacturing and create high-paying jobs.

The CHIPS and Science Act, passed in 2022, aims to enhance the United States’ semiconductor manufacturing capabilities. Rocket Lab’s expansion is a prime example of how this legislation is driving technological innovation and job creation. The company plans to leverage the Department of the Treasury’s Investment Tax Credit, potentially covering up to 25% of the project’s capital expenditures.

Share this article: