Insider Brief:

- Lynk Global has confirmed that it will go public via a merger with Slam Corp, a special purpose acquisition company (SPAC) led by former professional baseball player Alex Rodriguez.

- The merger could catapult Lynk Global to a $913.5 million post-money valuation.

- The influx of capital will enable the company to ramp up production to 12 satellites per month, with the goal of a constellation of 74 satellites that will be operational by late 2025, yielding an estimated $175 million in monthly revenue.

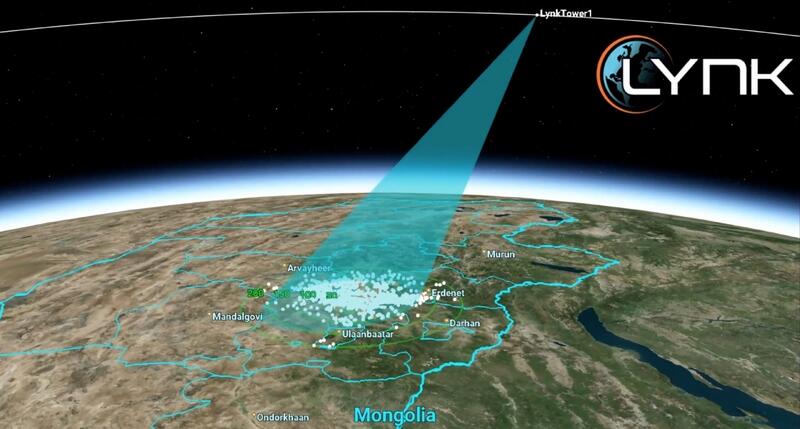

- Image credit: Lynk Global

In a strategic move poised to propel its satellite-to-phone connectivity services onto the global stage, Lynk Global has announced it will go public via a merger with Slam Corp, a special purpose acquisition company (SPAC) spearheaded by former professional baseball player Alex Rodriguez.

The confirmation of the deal came on Monday, following a non-binding Letter of Intent (LOI) between the two entities back in December 2023, as reported by TechCrunch. As outlined in the investor presentation submitted to regulators, the merger could catapult Lynk to a $913.5 million post-money valuation.

While Slam Corp will play a pivotal role in facilitating this transition, a significant portion of the capital infusion stems from existing shareholder equity rollover, private investment in public equity (PIPE), and a nominal sum from the SPAC’s trust fund.

Lynk Global, renowned for its innovative approach to providing connectivity via satellites, aims to expand its commercial footprint beyond existing markets like Palau. With aspirations to rival industry giants such as Starlink and AST Space Mobile, Lynk’s strategy revolves around deploying a constellation of satellites, colloquially termed “cell towers in space.” The company’s pioneering technology, compatible with unmodified cell phones including those on 2G networks, underscores its commitment to universal accessibility.

Unlike its competitors, Lynk adopts a wholesale model, partnering with mobile network operators (MNOs) to augment coverage and extend services globally. By leveraging existing spectrum rights held by telecom providers, Lynk endeavours to position itself as a trusted intermediary, facilitating seamless connectivity for MNOs’ subscribers.

The company’s value proposition lies in its ability to provide essential services in regions lacking conventional network coverage, thereby enabling emergency communications and other critical functions worldwide. While the specifics of monetization remain flexible, with emergency connectivity slated to be offered as a complimentary service, Lynk Global anticipates substantial revenue streams from its partnerships with MNOs.

In terms of scalability, Lynk boasts a streamlined satellite production process, with units taking just one month to assemble at a cost of approximately $650,000 per launch. Buoyed by the forthcoming influx of capital, the company aims to ramp up production to 12 satellites per month, envisioning a constellation of 74 satellites operational by late 2025, yielding an estimated $175 million in monthly revenue.

Acknowledging the challenges that other space companies have faced when going public via SPAC mergers, Lynk remains undeterred in its aspirations to debut on the Nasdaq. Despite Slam Corp’s hurdles, Lynk remains optimistic about the forthcoming transaction, slated for completion in the latter half of 2024. Upon listing, Lynk will trade under the ticker symbol $LYNK.

For more market insights, check out our latest space industry news here.

Share this article: