by Julia Seibert

If you find yourself to be anywhere on planet Earth, there is a good chance that a satellite is somewhere overhead. A spooky thought – but one that is down to probability rather than a grand conspiracy. The booming satellite industry has almost 10,000 active machines in orbit; over 20,000 more could be added within the next ten years (according to a rather conversative estimate). These trends are owed to decreasing launch costs coupled with miniaturization and standardization of satellites, and mean that doing business in orbit is easier than ever. However, such opportunities come accompanied by a growing importance of space in global affairs, which could affect future developments both in orbit and beyond.

Leading Satellite Companies

Internet: Starlink

Starlink, a satellite internet provider operated by launch giant SpaceX, began sending satellites to space in 2018. Now, it has over 5,000 functioning ones in orbit (according to Jonathan McDowell), accounting for more than half the total number of working satellites. However, Starlink shows no plans of stopping. Batches of satellites launch every few days atop a SpaceX Falcon 9 rocket with a preliminary goal of reaching 12,000 by 2027 (another 30,000 might be added later).

The reason for these numbers lies in Starlink’s business model. Satellites in Low Earth Orbit (LEO) ensure quick connectivity, but their low altitude restricts their field of communication to only encompass a small slice of Earth. In addition, the satellites’ orbital velocity means that they zoom over the globe too quickly to provide continuous connections. The solution, a thousand-fold web of Starlink satellites called a constellation, is already seeing success. Though Starlink is just beginning to be profitable and its customer base is much lower than hoped for, it has amazedthe US military by connecting to drones and gunships. More recently, it has played a vital role in the Ukraine war by providing internet for Ukrainian civilians and its military (the latter’s Starlink is now paid for by the US Department of Defense following disagreements from SpaceX regarding its use). Seeing the potential, SpaceX recently developed Starshield, a Starlink-based governmental satellite service.

Visit company’s profile page.

Honorable mentions: Kuiper, OneWeb

Telecommunications: SES

With over 70 satellites in geostationary (GEO) and medium Earth orbit (MEO), Luxembourgish telecommunications giant SES flaunts a wide range of services, divided into SES Video and Networks. Video, of which ‘the distribution of TV channels by satellite over Direct-to-Home (DTH)’ is a large part, is the most lucrative and makes up around 50% of the company’s revenue. Through this service, SES claims to deliver over 8,000 channels to over 369 million households. The other half of SES’s businesses, Networks, is described by the company as ‘connectivity (fixed and/or mobile) and data transmission services’. This is marketed towards aviation, maritime, and energy industries, as well as governmental customers. The latter make up the biggest chunk of Network revenue, its features including data for disaster management as well as for military operations.

Visit company’s profile page.

Honorable mentions: Intelsat, Telesat, Eutelsat

Earth Observation: Maxar

Twenty years ago, the technology behind 15-centimeter image resolution from orbit would have been behind lock and key. Today, Colorado-based Earth observation company Maxar Technologies regularly snaps images of the globe in such detail for its commercial customers. Many of them are governmental; while spy satellites for the US government can capture images in even higher definition, commercial imagery has its benefits, too. The fact that it is not classified, for example, allows the US government to use it to collaborate with allies. Also, Maxar’s fleet alone already surpasses the total amount of US spy satellites, resulting in more data and mission flexibility.

Maxar also markets its services as useful to energy, environmental, logistics, and entertainment industries (the latter, so the company, can benefit from satellite-enabled 3D terrain mapping). Recently, Maxar has demonstrated an ability to image other satellites in orbit, which has potential uses for satellite servicing and espionage.

Visit company’s profile page.

Honorable mentions: Blacksky, Planet Labs, Capella, Spire

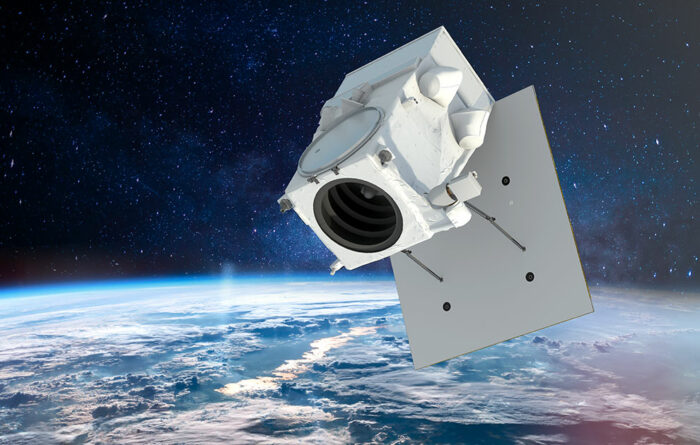

Space Sustainability: Astroscale

Though not quite comparable in size and spacecraft mass to the likes of Starlink, Astroscale is a leader in an increasingly important satellite industry: dealing with space debris. The Tokyo-based company, which also has offices in the US, Israel, Singapore, and the UK, envisions a multi-pronged approach to handle the problem. One method is to provide End of Life (EoL) services by using a specialized spacecraft (ELSA-M) to tug ageing satellites into a trajectory that will cause them to burn up in Earth’s atmosphere. ELSA-M should also be capable of capturing satellites tumbling out of control. Though the spacecraft has not yet flown, Astroscale has successfully demonstrated the capturing method with the 2021 ELSA-d demonstration mission.

Another mission, this time to demonstrate the inspection phase of Astroscale’s Active Debris Removal (ADS) service, was scheduled to launch in late 2023 but was delayed due to a grounded rocket. Adjacently, Astroscale’s US branch is planning to extend the life of satellites by sending a smaller craft – Life Extension In-orbit servicer, or LEXI – to piggyback older machines and keep their trajectory controlled.

Visit company’s profile page.

Challenges Space Satellite Companies Face

One significant challenge to satellite companies, especially young ones, is a high barrier to entry. Despite low launch costs and developments in technology making the field more accessible, designing, building, and launching a satellite – especially if it features technological innovations – costs millions. Depending on the service in question, it can take years to make back this money, let alone turn a profit. This makes it more difficult to impress investors, who are getting more selective, according to Vaibhav Lohiya, managing director and global head of space banking at Deutsche Bank Securities. There is more interest in near-term results rather than ‘moonshot opportunities’, he says, and rounds are getting smaller (as reported by SpaceNews). As space analysis firm Euroconsult points out, the situation is not made easier by inflation, supply chain issues, and limited availability of semiconductors. This issue, coupled with the difficulty of attracting investment, are likely two main reasons that the satellite constellation market is not growing as fast as once projected (as reported by SpaceNews).

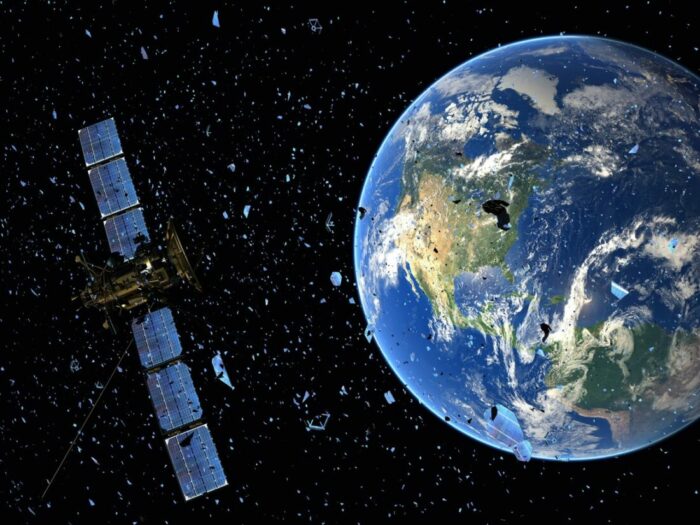

Other challenges are pertinent to the orbital environment itself. Among them is space debris, a growing problem that, if not controlled, could cause certain orbital planes to be unsafe for satellites and human missions alike. While some efforts to tackle it are underway, such as Astroscale’s spacecraft, few address the smaller pieces of junk that travel faster than a bullet (though in 2021, a Chinese startup launched a net-wielding robot to catch debris). This problem interlinks with a larger issue of lacking legislation, as international law on space in general – including space debris – is hazy at best. Domestic laws are not much better. For example, the US recently fined a company US $150,000 for not moving an old satellite out of harm’s way, but the company – DISH Network – had pulled in a revenue of US $16.7 billion the year before. Though the fine may send a message that domestic laws have some bite behind their bark, it is far from enough to meaningfully address the problem.

Space law’s nebulous nature poses problems beyond space debris, too. As satellites become increasingly important to terrestrial undertakings, they also become high-value targets. Though a handful of hard-kill tests – missiles targeting a satellite – have been done in the past, cyberattacks are a far more popular option as they are harder to trace, in addition to being cheaper and quicker. According to Walter Peeters, professor of space business and management at the International Space University, commercial satellites (as opposed to military ones) are especially vulnerable due to ‘a lack of awareness and implementation of security’. Cheap off-the-shelf satellite components, now common in the industry, are easy targets, as are the computer systems used by many ground stations, so Peeters. Legally, however, international law on such attacks is unclear. This ‘grey zone’, which leaves such attacks open to legal interpretation, could lead to conflict escalation.

The Future Outlook for Space Satellite Companies

The challenges might be significant, but by some estimates, the global satellite (and launch) market is projected to generate US $633 billion by 2032. According to Maureen Haverty, vice president at Seraphim Space Investment Trust, investments into satellites are finally beginning to ‘really pay off, which means there will continue to be a great deal of interest in all parts of the satellite industry’ (as reported by SpaceNews). To clinch such investments, satellite companies must ‘be nimble, innovative and have a healthy appetite for risk’, writes David Ziegler is vice president of Aerospace & Defense, Dassault Systèmes, meaning there is likely to be an influx of novel technologies in the sector. Examples might include the use of AIs (for image analysis, targeting systems, or trajectory guidance), or optical and perhaps even quantum communications.

These developments might open up new uses of satellites, as will the introduction of new heavy-lift launch vehicles like SpaceX’s Starship or Blue Origin’s New Glenn. Starship in particular is advertised as a high-cadence, low-cost option for launching massive payloads; if it delivers (which is still far off), this cheap, rapid deployment of entire constellations could further lower the access barrier and result in a more diverse orbital business scene. In addition, the comparative ease with which the commercial sector can implement new technologies is reflected by increased government interest in making use of them (for example, the US’s use of Maxar imagery and Starlink internet). Especially considering the implications of such technologies for information safety and warfare, these trends should be accompanied by more comprehensive legislation – but this is one area where development is gravely lacking.

For more market insights, check out our latest space industry news.

Featured image: Credit: SES

Share this article: