Brief:

- Series C1 funding closed at US $44 million with the support of Fonds de solidarité FTQ, Investissement Québec, BDC Capital, Climate Investment, Japan Energy Fund and BMO.

- The investment will enable the company to accelerate its go-to-market strategy, develop new integrated solutions, and deploy more satellite and airborne measurement capacity.

PRESS RELEASE — Montreal, Canada / September 7, 2023 – GHGSat, the global leader in greenhouse gas emissions intelligence, has completed its Series C1 funding round for a total of US$44 million in equity and debt. The company has raised more than US$126 million since its inception in 2011.

Equity participants in the funding round included Fonds de solidarité FTQ, BDC Capital, the investment arm of the Business Development Bank of Canada (BDC), the Government of Québec through Investissement Québec, Climate Investment, and the Japan Energy Fund. BofA Securities acted as the sole placement agent on the equity portion of the Series C1 funding round. The Bank of Montreal (BMO) has provided debt facilities to GHGSat.

This milestone underscores GHGSat’s leading position in greenhouse gas emissions intelligence and demonstrates strong investor confidence in the company. GHGSat enjoys longstanding support from existing investors who have reinvested in this Series C1 round, expanding the foundation for future growth and innovation.

GHGSat has grown rapidly since its last funding round two years ago. The company has generated an eightfold revenue surge since its previous funding round, supported by a fourfold increase in commercial satellites and a threefold increase in airborne sensors deployed. The company has also achieved key milestones in the development of next-generation measurement and AI technologies.

Over the same period, GHGSat has enabled the mitigation of 5.6 million tons of carbon dioxide equivalent emissions from industrial facilities around the world, which is equivalent to over 1.2 million gasoline-powered passenger vehicles driven for one year.

This new funding will enable the company to accelerate its go-to-market strategy, develop new integrated solutions, and deploy more satellite and airborne measurement capacity. GHGSat has satellite services agreements in place for hosted payloads on three new satellites scheduled to launch before the end of 2023 and another four new satellites scheduled for launch in 2024. One hosted payload in each of the 2023 and 2024 deployments will be dedicated to monitoring carbon dioxide. The company launched its first satellite in 2016 and now has nine satellites in orbit. GHGSat’s measurements have been rigorously validated by third-party commercial and scientific organizations.

“This new investment will enable GHGSat to accelerate growth further,” stated Stephane Germain, GHGSat CEO. “Over the last two years, we have proven that we can successfully scale and commercialize GHGSat’s world-class services while enabling real emissions mitigations, The business expansion is remarkable, and we’re gearing up to share more exciting updates in the forthcoming months.”

SOURCE: GHGSat

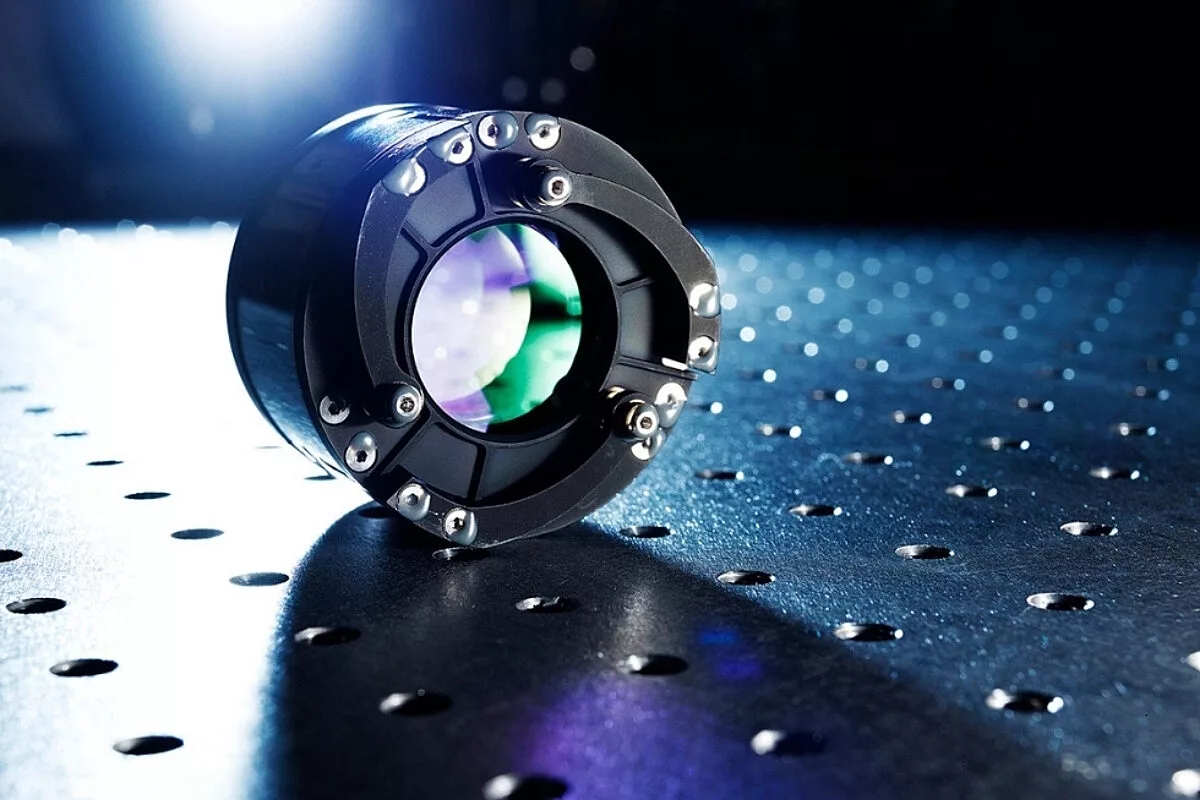

Featured image: The patented Wide-Angle Fabry Perot (WAF-P) imaging spectrometer. Credit: GHGSat

If you found this article to be informative, you can explore more current space industry news, exclusives, interviews, and podcasts.

Share this article: